Power Rental Market Size, Share, Trends, Key Drivers, Demand and Opportunity Analysis

The Power Rental Market: A Comprehensive Market Research Insight

1. Introduction

In an increasingly electrified and infrastructure-driven world, the Power Rental Market has emerged as a vital component of the global energy landscape. Power rental refers to the leasing or temporary deployment of power generation equipment—such as diesel or gas generators, mobile microgrids, and temporary battery storage systems—to meet short-term demand, support construction projects, respond to emergencies, and supplement grid capacity in areas with unstable or insufficient power supply.

This market has grown in importance as industries, governments, and communities seek flexible, scalable, and cost-effective power solutions. The relevance of power rental is underscored by rising infrastructure investment, increasing grid unreliability in certain regions, and heightened needs for backup during natural disasters or large events. As the global economy pivots toward resilient and reliable energy access, the power rental market is gaining traction.

Driven by urbanization, industrial growth, and climate-driven demand surges, the market is expected to expand rapidly. Many market analysts forecast a compound annual growth rate (CAGR) of around 6–8% over the next five years, making the power rental sector a strategically significant domain for energy companies, equipment providers, and policymakers alike.

Get strategic knowledge, trends, and forecasts with our Power Rental Market. Full report available for download:

https://www.databridgemarketresearch.com/reports/global-power-rental-market

2. Market Overview

At its core, the power rental market encompasses the temporary provision of power generation assets for diverse needs. The market scope ranges from small portable generators for residential or event-based use to large modular power plants and microgrids designed to support industrial sites or remote communities.

Estimating global market size is challenging due to varied reporting, but based on historical growth and current demand trajectories, the market in 2024 is likely valued between USD 12 billion and USD 16 billion. Over the past decade, it has grown steadily, as infrastructure development, disaster recovery, and backup power use surged globally.

Historically, the power rental market has been shaped by cycles of investment correlating with major construction booms, international development projects, and natural disasters. In the early 2010s, many emerging markets began relying on rented generators to provide interim power during grid expansion. In contrast, mature economies primarily used rental solutions for short-term events and backup. Over time, the adoption of temporary battery-based systems and microgrids has added sophistication and scale, broadening use cases.

Today, the market is well-positioned to capitalize on both legacy use (diesel generator hire) and emerging trends (off-grid microgrids, battery storage as a service). On the demand side, sectors such as construction, oil & gas, mining, telecommunications, and events drive significant consumption. On the supply side, rental companies compete by offering modular, fuel-efficient equipment, logistics services, and remote monitoring capabilities.

The demand-supply dynamics reflect a tight balance: in many high-demand periods, rental providers may face shortages of equipment, especially in regions hit by natural disasters or during peak event seasons. Conversely, in off-peak times, idle inventory can pose financial strain, prompting firms to innovate with flexible leasing, managed services, and hybrid power models.

3. Key Market Drivers

Several major forces are propelling the growth of the power rental market:

Infrastructure and Construction Boom

As developing economies invest heavily in infrastructure—from roads and bridges to data centers and manufacturing facilities—the need for interim power solutions is rising. Construction sites often require reliable electricity before grid connections are fully established.

Industrial Expansion and Mining

Industries such as mining, oil & gas, and manufacturing increasingly operate in remote or underserved locations. Power rental offers a practical, scalable solution for powering these operations without the long lead times and capital expense of building permanent power plants.

Grid Instability and Resilience Needs

Many regions continue to face grid unreliability due to aging infrastructure, underinvestment, or environmental disruption. Power rental services provide businesses and communities with critical backup power, ensuring continuity during blackouts or peak demand periods.

Disaster Recovery and Emergency Preparedness

Natural disasters—hurricanes, floods, earthquakes—frequently disrupt power supply. Rental companies are often first responders, delivering temporary power to aid relief efforts, hospitals, shelters, and affected communities.

Technological Advancements

The proliferation of modular and containerized power plants, remote monitoring, and predictive maintenance has significantly increased the efficiency and cost-effectiveness of leased power. Moreover, innovations in battery storage (especially lithium-ion) and hybrid systems combine renewable sources with diesel or gas, reducing fuel costs and emissions.

Sustainability and Environmental Regulation

As environmental regulations tighten, companies are under pressure to reduce emissions. Rental providers are responding by offering cleaner generators, low-emission portable plants, and battery-based microgrids. This shift is appealing to customers seeking greener, temporary power options.

Investment and Financing

Private equity, infrastructure funds, and green finance institutions are increasingly backing power rental firms, particularly those offering clean and hybrid solutions. These investments lower the capital burden on rental companies and expand their capacity to scale.

Growth in Events and Commercial Use

Large events—concerts, festivals, sports tournaments—demand significant on-site power. Rental providers serve event organizers by supplying portable generators and lighting systems, often bundled with logistic and operational support.

4. Market Challenges

Despite robust opportunity, the power rental market faces several critical challenges and risks:

Regulation and Permitting

Navigating environmental regulations, noise ordinances, and emissions standards can be complex, especially in urban or sensitive areas. Securing permits for generator placement or containerized plants may be time-consuming and costly.

Fuel Logistics and Cost Volatility

Diesel and gas prices are subject to global market fluctuations, affecting operating costs. Additionally, transporting fuel to remote sites can be logistically challenging and expensive, especially in areas with poor infrastructure.

Environmental and Social Impacts

Conventional generator rentals are associated with carbon emissions, air pollution, and noise. These externalities can create social resistance, especially in populated or environmentally regulated regions.

Competition from Renewables

As solar, wind, and battery storage costs continue to decline, permanent renewable installations become more attractive. This dynamic could erode demand for traditional diesel-based rental solutions over time.

Operational Complexity

Running a rental fleet at scale involves logistics, maintenance, remote monitoring, and spare parts management. Ensuring uptime and reliability in harsh or distant locations adds operational risk.

Financial Risks

Rental companies often need to make large upfront capital expenditures to build or acquire equipment. If utilization is low or credit markets tighten, these firms may face cash-flow stress.

Technological Obsolescence

As technology evolves rapidly, there is a risk that rental equipment—especially batteries or hybrid containers—could become outdated, pressing providers to continually reinvest.

5. Market Segmentation

To better understand the dynamics of the power rental market, we can segment it along three key dimensions: Type, Application, and Region.

By Type / Category

Diesel and Gas Generators: Traditional, widely used, portable; well-suited for short-term or remote deployments.

Hybrid Systems: Combine generators with battery storage or renewable sources (solar, wind) to optimize fuel consumption and emissions.

Battery Storage Systems / Mobile Microgrids: Containerized or modular battery-based solutions that may be paired with renewables for cleaner temporary power.

Renewable-based Temporary Plants: Solar, wind rental or leased microgrids used for events, remote sites, or as transition solutions where grid access is being built.

By Application / Use Case

Construction and Infrastructure: Power rental for construction sites, temporary camps, and infrastructure projects.

Industrial and Mining: Remote operations requiring power for heavy machinery, processing, or base camps.

Oil & Gas: Exploration, drilling, and production sites often rely on rented power for flexibility.

Events and Entertainment: Concerts, festivals, sports events, and outdoor gatherings needing on-site power.

Emergency & Disaster Recovery: First-response power for disaster-stricken regions or backup for critical facilities.

Telecom and Data Centers: Temporary or on-demand power for mobile towers or data infrastructure in underserved or disrupted regions.

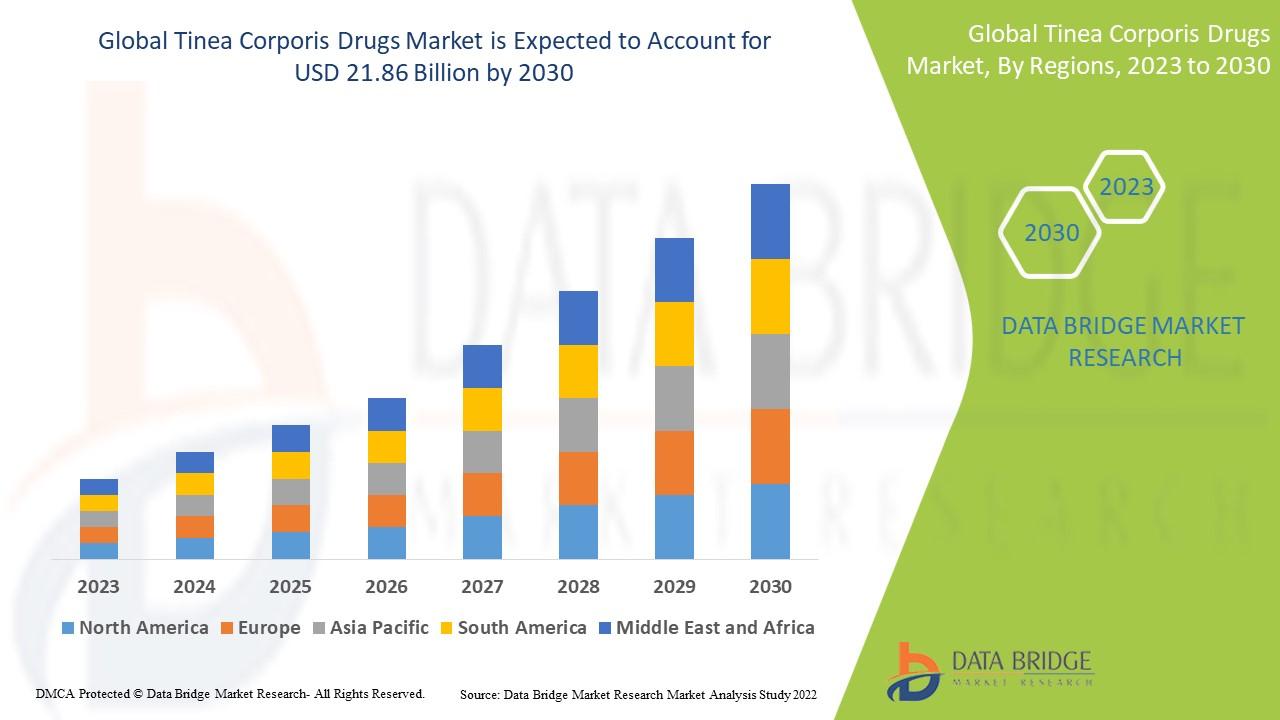

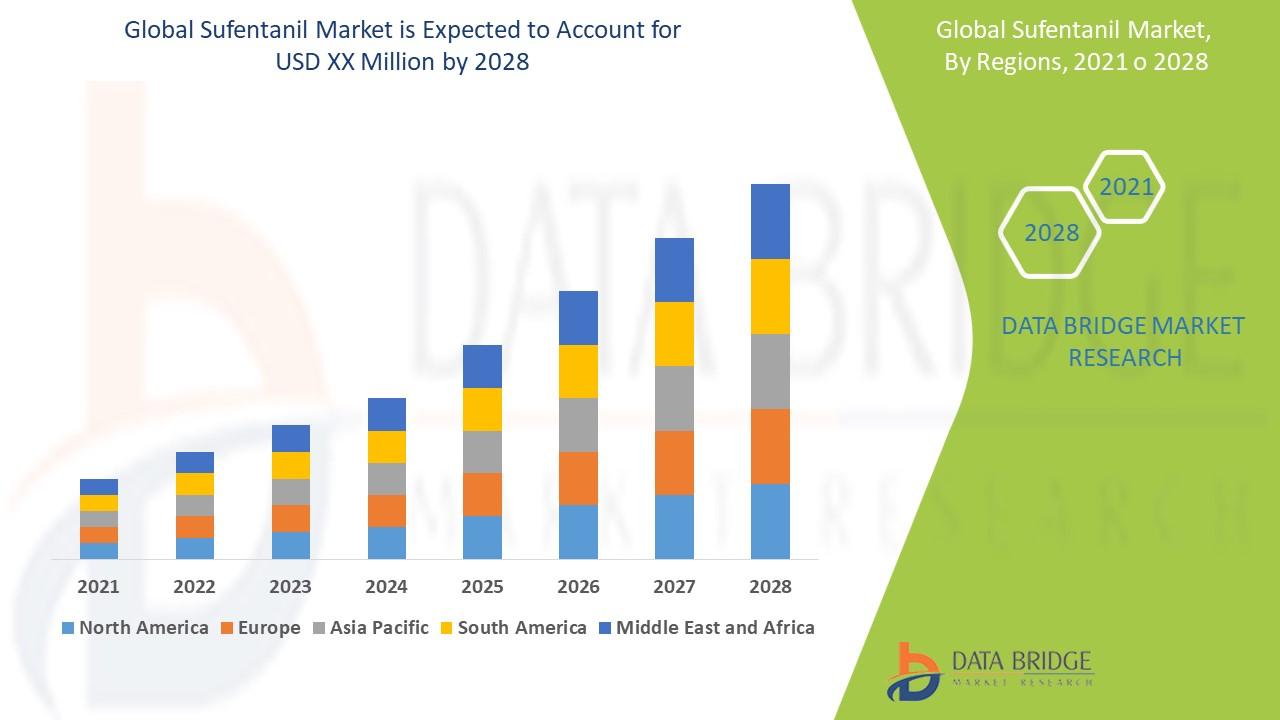

By Region

North America: Highly developed rental market with strong regulation, advanced technology adoption, and mature infrastructure.

Europe: Stringent emissions standards push demand for cleaner rental solutions; strong event and construction sectors.

Asia-Pacific (APAC): Rapid infrastructure growth, emerging power grid challenges, high adoption in construction and industry.

Latin America: Grid instability and remote mining operations drive demand; growing interest in hybrid solutions.

Middle East & Africa (MEA): Remote oil & gas sites, infrastructure build-out, and limited grid coverage create high demand for rented power.

Fastest-Growing Segment

Among these segments, hybrid systems (generators + battery) and mobile microgrids are emerging the fastest, primarily due to sustainability demands and high fuel costs. Geographically, Asia-Pacific and Middle East & Africa are expected to achieve the highest growth rates, driven by infrastructure investment, industrial expansion, and weak grid penetration in remote zones.

6. Regional Analysis

A regional breakdown reveals where the power rental market is most mature, and where opportunities are rapidly unfolding.

North America

In North America, the power rental market is mature and competitive. Companies offer a broad portfolio—from small portable units for events to containerized microgrids for industrial or utility-scale use. Environmental regulations are stringent, prompting a gradual shift toward hybrid and low-emission solutions. Demand is driven by construction, data center expansion, and disaster preparedness in areas prone to storms or grid instability. Leading firms differentiate themselves via logistics networks, predictive maintenance, and integrated service offerings.

Europe

The European market is characterized by high regulatory scrutiny around emissions, noise, and fuel quality. These factors drive strong demand for cleaner, hybrid, and battery-based rental systems. Events and construction sectors also contribute significantly. Governments across Europe are increasingly encouraging low-carbon rentals, sometimes incentivizing green microgrids or storage systems. Overall, Europe offers a steady and evolving rental market focused on sustainability.

Asia-Pacific (APAC)

APAC is one of the fastest-growing regions for power rental. Rapid urbanization, large-scale infrastructure projects, and industrial expansion drive strong demand for temporary power solutions. In many emerging economies, grid reliability remains a challenge, making leased generators essential. Additionally, investments in renewable energy are fueling the adoption of hybrid and mobile microgrid solutions. Key countries include India, China, Indonesia, and Southeast Asian economies, where both construction and industrial segments are booming.

Latin America

Latin America’s power rental market benefits from widespread grid unreliability, especially in rural and remote mining or agricultural regions. Mining operations, in particular, rely heavily on rented power. Events, tourism infrastructure, and construction also contribute. While diesel-based solutions remain dominant, there is a growing shift toward hybrid rentals and containerized plants, driven by cost pressures and environmental concerns.

Middle East & Africa (MEA)

The MEA region offers compelling opportunities. Demand is high in remote oil & gas installations, construction of infrastructure, and remote communities without grid access. Additionally, the political emphasis on economic development is fueling infrastructure investments, necessitating temporary but reliable power solutions. Rental providers often deploy modular power plants and hybrid microgrids. Furthermore, renewable-backed rentals are gaining traction, aligned with regional sustainability goals.

7. Competitive Landscape

The power rental market features a mix of global conglomerates, regional specialists, and emerging technology-driven firms. Key players include large equipment rental companies, specialized power solution providers, and hybrid or microgrid innovators.

Aggreko plc: A global leader in the power rental space, offering modular power plants, microgrids, and battery solutions. Aggreko differentiates through scale, global reach, and integrated service models including site design, installation, and remote monitoring.

Cummins Inc.: Known for its engine/generator technology, Cummins supports rental firms but also offers turnkey rental units. Their strength lies in robust, fuel-efficient gensets and a global service network.

Kohler Co.: Provides a broad range of portable and industrial generators. While historically focused on sales, many rental companies partner with or source from Kohler for reliable diesel and gas units.

CAT (Caterpillar Inc.): A major equipment provider whose generators are commonly rented. Rental companies leverage CAT’s durability, service capabilities, and global footprint.

EcoFlow & Other Battery Innovators: Although not traditional power rental companies, newer battery-based firms are entering the rental market by offering containerized storage systems or mobile microgrids, often in partnership with rental firms or infrastructure developers.

Local & Regional Specialists: In many emerging markets, local rental companies adapt to regional conditions—offering fuel delivery, site logistics, customized modular plants, and region-specific financing models.

Strategic Comparisons:

Innovation: Aggreko leads on modular microgrid offerings, while battery innovators push the envelope on zero-emission, containerized power.

Pricing: Traditional generator-based rental providers often compete on unit cost and fuel efficiency. Battery and hybrid providers may charge a premium initially but offer lower operating costs and environmental benefits.

Partnerships & M&A: Increasingly, large rental companies are partnering with battery startups or acquiring energy-tech firms to expand their hybrid and storage offerings. For example, a rental firm might partner with a battery company to deploy containerized storage at remote sites. These partnerships broaden service offerings and improve competitive positioning.

Service Differentiation: Remote monitoring, predictive analytics, and full-solution deployment (site assessment, installation, maintenance) are becoming key differentiators. Firms that provide end-to-end power rental solutions with strong after-sales service tend to win large industrial or government contracts.

8. Future Trends & Opportunities

Looking ahead over the next 5–10 years, several trends and opportunities are likely to reshape the power rental market:

Acceleration of Hybrid and Renewable Solutions

The shift from diesel-only fleets to hybrid systems (diesel + battery) or fully renewable microgrids will intensify, driven by cost declines in battery storage and regulatory pressure. This will open new revenue streams for rental companies offering greener, more flexible power.

Decentralized Energy-as-a-Service (EaaS)

Business models will likely evolve toward energy-as-a-service, where customers pay for power delivered rather than for the equipment itself. This could include pay-per-kilowatt-hour models, subscription-based microgrid access, or managed energy services.

Digitalization and Remote Monitoring

The use of IoT, predictive maintenance, and cloud-based control systems will become mainstream, reducing operational costs, improving uptime, and enabling more efficient fleet utilization.

Scalable Microgrids for Emergencies

Rental providers will increasingly deploy rapid-deployment microgrids for disaster recovery, humanitarian operations, and temporary infrastructure. These modular systems can scale depending on demand and logistics.

Electrification of Construction Sites

As construction equipment becomes electrified, powered by rented battery or hybrid systems, entire sites may rely less on diesel generators and more on clean rented power solutions.

Policy Incentives and Green Financing

Governments and development banks may offer incentives, grants, or low-interest financing for sustainable rental power infrastructure, such as battery microgrids or low-emission generators. This can accelerate adoption in emerging markets.

Strategic Alliances and Consolidation

Expect consolidation as large rental companies acquire or merge with renewable or battery-technology firms. Alliances with infrastructure developers, telecom tower companies, and utilities will also increase.

Expansion into Emerging Markets

Regions such as Africa, Southeast Asia, and Latin America will see accelerated growth as rental companies expand their footprint, supported by international investment and local partnerships.

Opportunities for Stakeholders:

Businesses (rental firms) can differentiate by investing in hybrid fleets, digital services, and EaaS models.

Investors can target fast-growing rental companies focused on sustainable technology and energy-as-a-service.

Policymakers can design incentives and frameworks to support low-emission temporary power, especially in disaster-prone and grid-constrained regions.

9. Conclusion

The Power Rental Market stands at a pivotal juncture. What once was predominantly a diesel-generator rental business has evolved into a complex, technology-driven ecosystem—incorporating hybrid systems, microgrids, and energy-as-a-service models. With a projected CAGR of 6–8% over the coming years, the market offers attractive growth potential, particularly in regions with infrastructure deficits, grid instability, or disaster risk.

Key insights from this analysis include:

A clear shift toward cleaner, hybrid, and modular power solutions, as environmental and operational pressures mount.

Demand being driven by construction, industrial, mining, telecom, and emergency response sectors.

Asia-Pacific and Middle East & Africa emerging as high-growth regions, thanks to infrastructure investments and off-grid deployment needs.

Competitive differentiation increasingly coming from digital service capabilities, remote monitoring, and full-service solutions.

Strong opportunities for energy-as-a-service business models and green financing to accelerate adoption.

For businesses considering entry or expansion in this market, the time is ripe to invest in battery-based fleets, deploy microgrids, and build partnerships across the value chain. Stakeholders such as investors and policymakers can play a pivotal role in shaping a more sustainable and resilient power rental industry.

Call to Action:

Rental companies should map out a clear roadmap to transition to hybrid and renewable-powered fleets, investing in digital platforms and maintenance capabilities.

Investors should evaluate power rental firms that combine technological innovation and environmental sustainability—especially in underserved markets.

Policymakers and regulators should support deployment of low-emission temporary power solutions through incentives, streamlined permitting, and disaster response frameworks.

Browse More Reports:

Global Major Domestic Cooking Appliances Market

Global Mining Machinery Market

Global Nursing Homes and Long-Term Care Facilities Market

Global Phototherapy Market

Global Push to Talk (Ptt) Market

Global Spatial Light Modulator Market

Global Fluff Pulp Market

Global Renewable Energy Connector Market

Global Bacterial Vaccines Market

Global Machine Control System Market

Global Biodegradable Algae Water Bottles Market

Global Cosmetics Original Design Manufacturing (ODM) Market

Global Human Rabies Vaccines Market

Global Polyfilm Market

Global Ultraviolet (UV) Curing System Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"